When I needed to buy boat insurance for our 30-foot Black Watch, the No Problem, I didn’t know where to begin. As I looked into it, I discovered that a standard policy might not necessarily give me the coverage I thought it would — as many folks in our region unfortunately found out after Hurricane Sandy. I reached out to my friend Shawn Almeida from Almeida & Carlson Insurance Agency. The Almeida family has been providing marine insurance on the East Coast for a long time. He was able to give me some basic boat insurance tips and explain the different options and terminology in ways I could understand.

Essentially, there are three different ways to write marine insurance, and which one is right for you depends on how you plan to fish with your boat. If you’re like most people and only fish recreationally, you would need a boat/yacht policy. If you fish commercially, you need a policy with commercial hull plus protection and indemnity. The third option is a charter boat policy, which Shawn explained has evolved over the last 15 years and now is basically a boat/yacht policy customized for a charter captain.

Standard Marine Coverage

For our purposes, I’ll focus on a boat/yacht policy. Hull and Equipment coverage refers to physical damage to your boat, including electronics. The amount of insurance to purchase should be based on the purchase price of the boat or its survey value. Make sure that the hull coverage of whatever insurance you do buy is written on an agreed-amount basis. There are insurers out there who write hull coverage on an actual cash-value basis, which takes depreciation into account. Many folks wonder about covering the replacement cost of a vessel, but in marine insurance, there are no true replacement-cost policies available.

Once a vessel’s value is determined, you then choose a deductible. Shawn explained to me that the deductible can vary from 1% to 5% of a boat’s value, and a smaller boat’s deductible may sometimes be set at $250 or $500.

A standard policy also offers liability coverage that provides protection if you are responsible for bodily injury or property damage. It will also cover personal property you own while it is aboard your boat. Towing and assistance may be covered; if it is, the policy will specify up to what dollar value. If bodily injury is caused by the owner or operator of an uninsured boat, a boat and yacht policy has your back there as well. If you accidentally cause a fuel spill or environmental damage, a boat/yacht policy will generally provide coverage for that situation too. The policy also covers medical, hospital, ambulance, and funeral costs related to anyone who suffered accidental bodily injury.

Optional Coverage/ Endorsements

Optional coverage is referred to as an endorsement, and the list of things you can choose to cover includes trailers, tenders, rods and reels and electronics, to name a few. Hurricane haul-out coverage is often included, meaning a hurricane warning or watch triggers eligibility to be compensated for pulling your boat out of the water, but each insurance company is different. “Additional Insured” is something you may be required to add if you keep your boat at a marina. This would cover the marina’s interest if your boat causes damage to surrounding boats or property. An endorsement for incidental chartering of a small number of trips per year is an option, but more than 10 trips means you probably need a charter policy.

A bluefin tuna fisherman who wants to catch a giant and sell it, or a weekend warrior commercial striped bass fisherman, would both need a “sell catch” endorsements on their policies. For instance, if your boat starts taking on water and you are deemed to be fishing commercially, your insurance policy will not cover the loss unless you have a Sell Catch endorsement on your policy.

Other Conditions

Make sure to talk to your insurance agent about your lay-up period and navigation area. If you’re like me, you fish late into the season, well into the fall. I say there is no offseason, but eventually I give in and take the boat out of the water sometime around December 1. The lay-up period is a discount on the insurance cost for the amount of time the boat is not in use, either ashore or afloat. The boat is still fully covered as long as it’s not a live-aboard, isn’t able to navigate, and is not ready for immediate use—in other words, as long as it’s winterized. However, most insurance companies offer lay-up discounts only for boats over 26 feet.

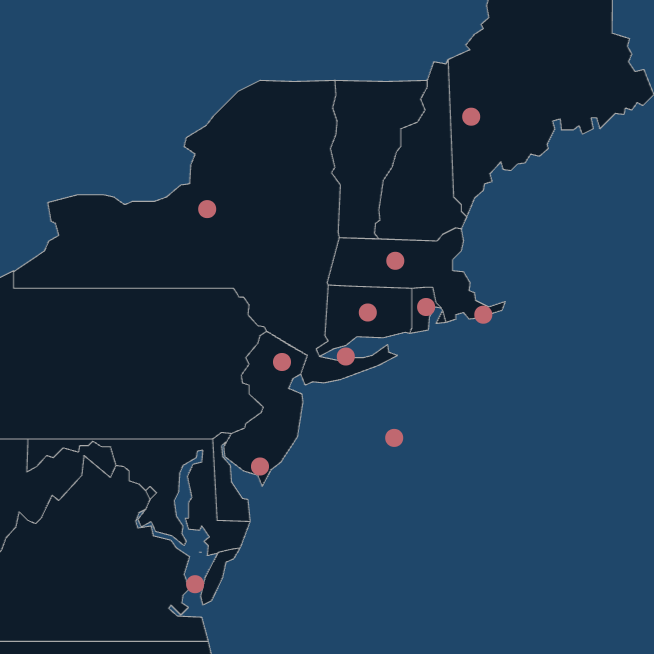

The “navigation area” is also a consideration that typically applies to larger vessels traveling the coast. Eastport, Maine to Morehead, North Carolina is a typical navigation area for northeast boaters, but that can vary from company to company. Big boats aren’t allowed south until after the hurricane season ends on November 1. A policy may also be “inland” or “coastal,” and cost different amounts. Inland coverage would be for boating on lakes, rivers and tributaries; coastal covers you in coastal waters. This coverage can vary, though; some are specified at inside 75 miles, while others are more ambiguous and only state “coastal waters of the United States.” It’s worth checking, before you head 100 miles out to the canyons, whether your policy has stipulations in this regard. Also, a coastal policy will cover you inland, but an inland policy will not cover you in coastal waters. If you live inland and use your boat primarily in lakes and rivers, you should call your agent for insurance tips if you’re planning on trailering to the coast. The company’s underwriter can grant “permission” or write an endorsement to your policy to cover a few days of fishing in coastal waters.

Exclusions

Your policy will most likely include several exclusions. These usually refer to naturally-occurring wear and tear on the boat (like rust or rot), wear caused naturally (by insects, animals or marine life), osmosis or even hull blisters.

Vessel Depreciation

Most of your boat’s property is subject to depreciation, including the canvas, upholstery, outboard engines, machinery over 10 years old, batteries and trailers. Keep in mind that this depreciation may affect the overall value of your boat.

Rating Credits

There are several ways to earn credits on your premium. A captain’s license can earn as much as a 10% discount; a safe boating course alone can save you 5%. Outboard and diesel engines are deemed safer than inboard gas engines and carry a larger credit. Safety equipment will also earn you some savings, and having a GPS or radar can save you as much as 5%.

Rating Surcharges

Just as with your home or auto insurance policy, you can be hit with surcharges. Your automobile driving record, boating experience, maximum speed of your boat, or past losses can all affect your premium cost in a negative way.

Marine Surveys

New boats don’t need a survey if they were built by a reputable boat manufacturer. If your boat is more than 10 years old, you may be required to obtain a survey, and one may then be required every three years after that. Some companies require a survey for any boat 26 feet and up, while others set the limit at 30 feet and up. The owner of a smaller boat may be required to perform a “self survey,” which usually consists of a checklist and boat photos.

A professional boat survey should be conducted by an accredited SAMS or NAMS surveyor. Shawn suggests obtaining a survey on every used boat before purchasing it to avoid any insurability headaches down the road. Additionally, a good surveyor will alert you to any problems before the purchase so that you don’t buy a boat that’s not seaworthy and end up with an expensive lawn ornament.

As you can see, many nuances exist in marine coverage. You’re paying good money to have your boat insured, so it’s worth it to sit down with a marine insurance professional. He or she will review how you plan to use your boat and explain exactly what is and isn’t covered if a catastrophe strikes.

[…] Boat Owner Basics: Top Boat Insurance Tips for 2013 – On The Water […]

[…] Boat Owner Basics: Top Boat Insurance Tips for 2013 – On The Water […]